I sat across from a friend in a coffee shop last week.

He has run a successful agency for seven years. By most metrics he is winning.

The revenue is high and his reputation is solid. But he looked exhausted.

He wanted out. He wanted to sell the company and move on to a software product he had been dreaming about for months.

I asked him a simple question.

Who buys the company?

He stared at his coffee. He did not have an answer.

The reality was that no one would buy his company. He had not built a business. He had built a high paying job for himself that required his specific personality and his specific network to function.

He could not sell because the asset was inextricable from the owner.

This is a common tragedy in the startup world.

We often conflate the idea of an exit strategy with the act of quitting.

We worry that thinking about the end means we lack commitment to the present.

But the data suggests the opposite.

Beginning with the end in mind is not about leaving. It is about engineering.

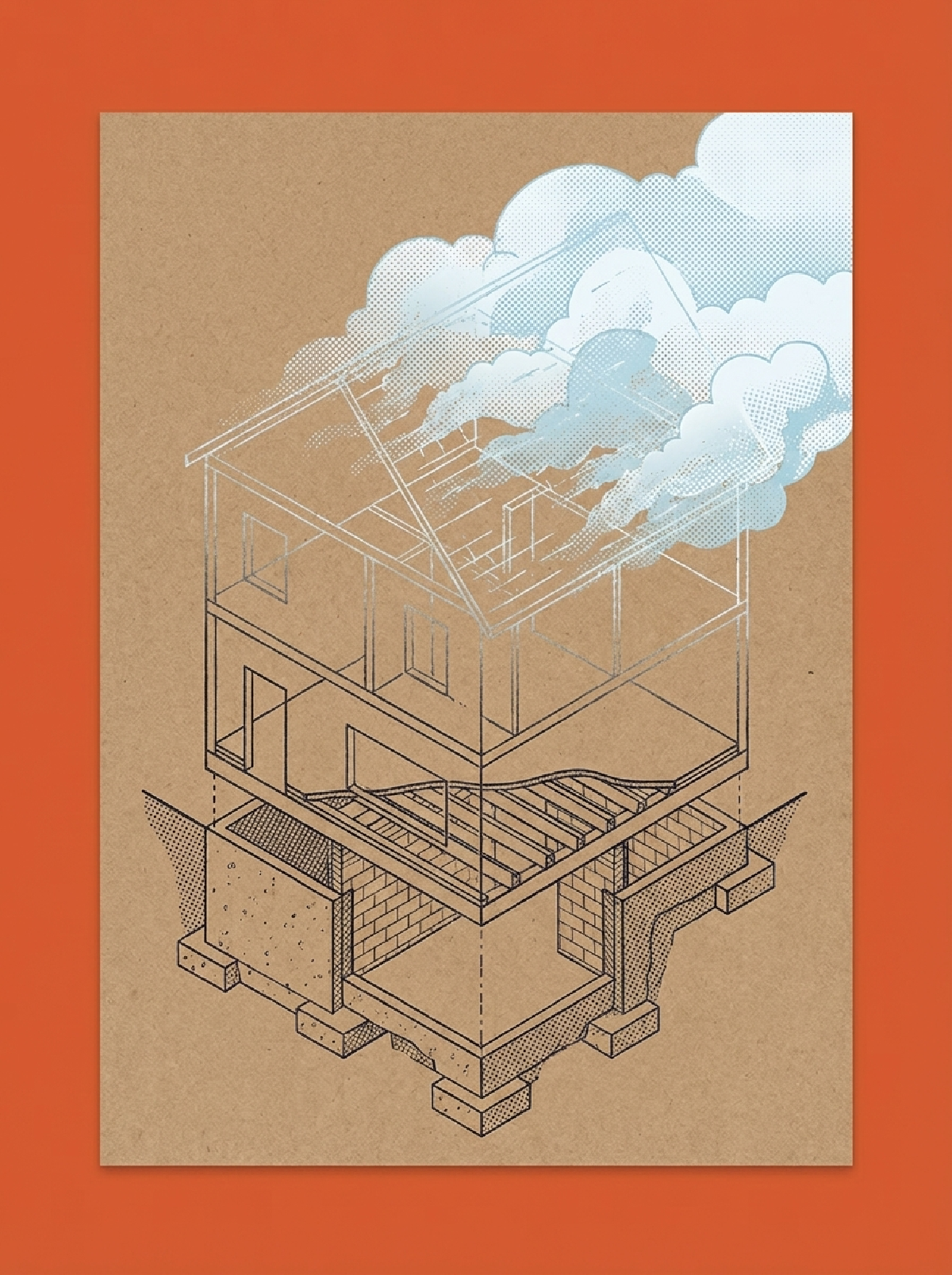

The Architecture of Value

#When you decide to build a house you must first decide what the house is for.

A single family home has a different foundation than a skyscraper.

If you pour the foundation for a small cottage you cannot decide five years later to put thirty stories of steel on top of it.

Business works the same way.

The exit strategy you choose dictates the operational decisions you make on a Tuesday morning three years before you ever sign a letter of intent.

There are generally three main avenues for a founder.

- The Strategic Acquisition: You are building something that plugs a hole for a larger incumbent. This requires proprietary technology or a massive, specific user base.

- The Financial Exit: You are building a cash flow machine. Private Equity firms or individual buyers want stable, predictable EBITDA.

- The IPO: You are building an institution that can survive public market scrutiny. This requires rigorous governance and massive scale.

If you do not know which one you are aiming for you will likely optimize for the wrong things.

My friend optimized for cash flow but failed to build the systems required for a financial buyer to step in.

He wanted a strategic buyout but had developed no proprietary intellectual property.

He was stuck in the middle.

This leads us to a difficult question we often avoid asking ourselves.

Are we building an asset or are we building an ego project?

The Founder Paradox

#Founders are often driven by a need for significance.

We want to be the one who solves the problem. We want to be the hero of the story.

But a sellable business requires the founder to become irrelevant.

This creates a psychological conflict.

To build something valuable you must design yourself out of the equation.

You have to build systems that work when you are sleeping. You have to hire people who are better than you at critical tasks.

You have to document processes so clearly that a stranger could read them and run your department.

This feels like a loss of control.

It feels like you are making yourself expendable.

And you are.

That is the point.

A business that depends on the founder for survival is not a business. It is a dependency.

Dependencies are liabilities. They lower valuations.

When we look at the mechanics of valuation we see that risk is the primary lever.

Buyers do not just pay for potential upside. They discount heavily for risk.

Key person risk is often the highest discount applied to small businesses.

If you get hit by a bus does the revenue stop?

If the answer is yes the value of your equity drops toward zero.

Therefore an exit strategy is actually a risk mitigation strategy.

It forces you to ask hard questions about redundancy and autonomy.

Reverse Engineering the Timeline

#Let us look at the math of a timeline.

If you want to sell in five years you need to start cleaning up your books today.

Most acquirers will want to see three years of clean, audited or reviewable financials.

They want to see metrics that align with their industry standards.

If you are a SaaS company they want to see low churn and high net revenue retention.

If you are a service business they want to see recurring contracts and low customer concentration.

If one client makes up 40% of your revenue you are unsellable to most sophisticated buyers.

These are not things you can fix three months before a sale.

Changing your customer concentration takes years of sales effort.

Switching from cash to accrual accounting takes time and money.

Implementing a management layer so you are not the direct report for ten people takes culture shifting.

This is why the “exit” is actually an operational framework.

It provides the constraints that make decision making easier.

Should you take that massive contract from a nightmare client?

If your goal is a lifestyle business for twenty years perhaps you do. The cash is good.

If your goal is a strategic exit in two years perhaps you do not. It skews your concentration and adds operational debt.

The destination clarifies the path.

The Unknown Variables

#There are still things we cannot know. We cannot predict the macro economic environment five years from now.

Interest rates change. Capital becomes expensive or cheap. We also do not know how we will change as people.

The things that motivate you today might bore you in a decade. The energy you have for the grind might dissipate as your family grows or your priorities shift.

I have seen founders trapped in businesses they hate because they never planned a way out.

They assumed they would always love the work.

They were wrong.

This brings us back to the concept of optionality.

A clearly defined exit strategy does not force you to sell.

It simply gives you the option to do so.

If you build a company that is ready to be sold you have built a company that is a joy to own.

It runs smoothly. It has clear financials. It has a strong team.

You might decide to keep it forever.

But you have the choice.

My friend at the coffee shop did not have a choice.

He was a prisoner of his own lack of foresight.

He had to go back to work the next day and grind because the machine stopped turning without him.

We need to stop viewing the exit as a betrayal of the mission.

It is the ultimate fulfillment of the mission.

It means you have built something that has value independent of its creator.

It means you built something that lasts.