A down round is a financing event in which a startup raises capital at a valuation lower than the valuation set in its previous round of funding. It is effectively a repricing of the company. It signals that the market believes the company is worth less today than it was in the past.

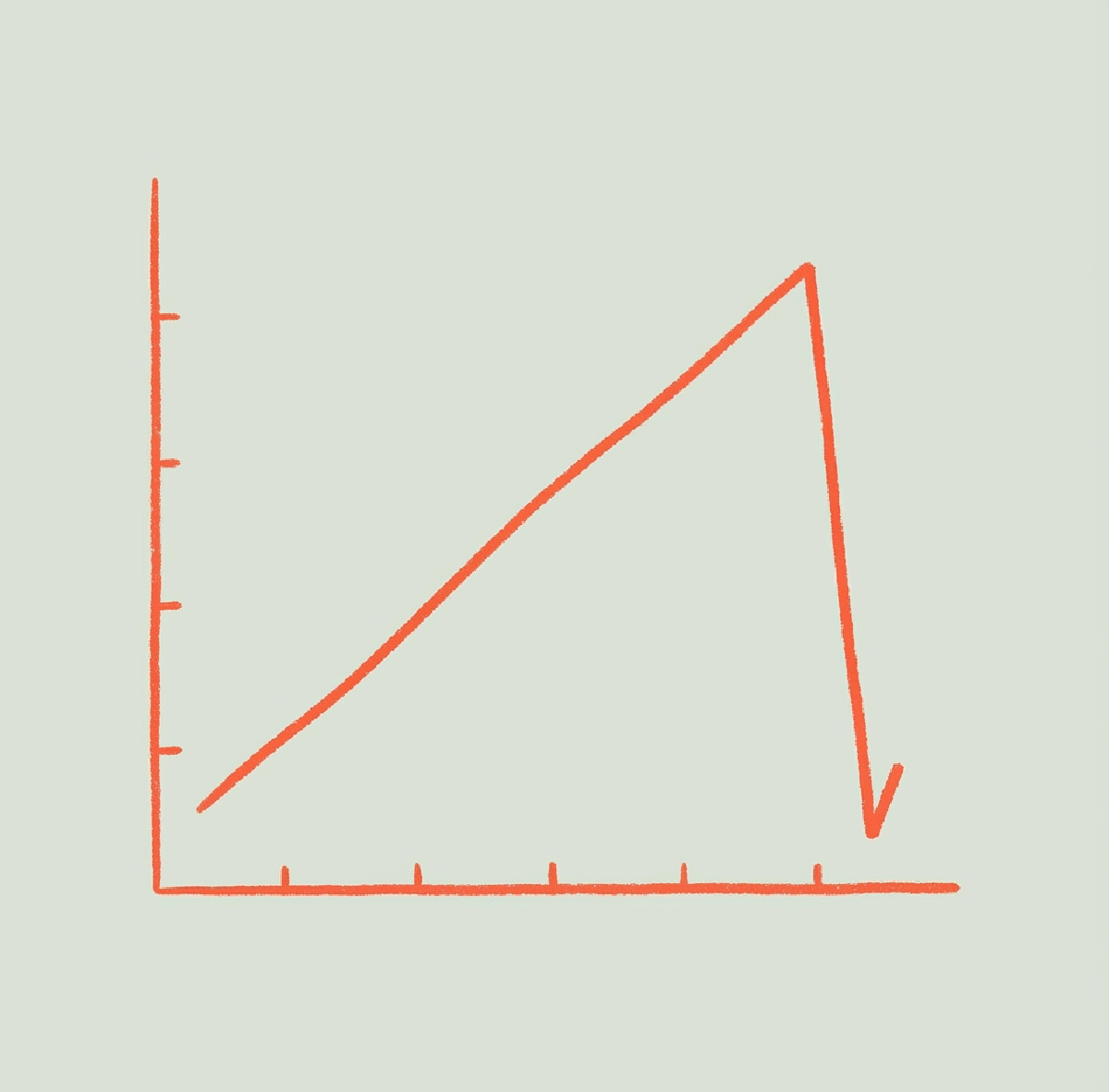

For a founder, this is one of the most difficult situations to navigate. In the typical startup narrative, the valuation chart always moves up and to the right. A down round breaks this trend. It is a public admission that growth targets were missed, the market conditions have deteriorated, or the previous valuation was simply too high and disconnected from reality.

While it is often viewed as a failure, it is sometimes a necessary survival tactic. Taking a valuation hit is painful, but running out of cash is fatal. A down round keeps the lights on.

The Mechanics of Dilution and Ratchets

#The primary consequence of a down round is massive dilution. Because the share price has dropped, you must sell significantly more shares to raise the same amount of cash.

However, the pain often goes deeper due to “anti-dilution” protections. Most professional investors have clauses in their contracts known as ratchets. These clauses protect early investors from losing value in a down round.

If you raise money at a lower price, the anti-dilution provision kicks in. The company is forced to issue additional free shares to the previous investors to adjust their price per share effectively downwards. This creates a double hit of dilution. The new investors get a big chunk of the company because the price is low. The old investors get more shares to compensate them for the drop.

Who pays for this? The common stockholders. That usually means the founders and the employees suffer the most dilution.

Impact on Employee Morale

#A down round wreaks havoc on your team’s compensation. Employees join startups largely for the stock options. They accept lower cash salaries in exchange for the potential upside of equity.

When a down round occurs, the value of the common stock drops. It often leads to a situation where the stock options are “underwater.” This means the current value of the stock is lower than the strike price the employee has to pay to buy it. Their equity is effectively worthless.

Founders in this scenario face a difficult management challenge. You may need to reissue options at a lower price or offer retention bonuses to keep key talent from walking out the door.

Down Round versus The Alternative

#Comparing a down round to an up round is obvious, but the more important comparison is against the alternative: bankruptcy.

There are other options to consider before accepting a lower valuation:

- Flat Round: Raising money at the exact same valuation as the previous round. This is a “sideways” move but avoids the optical damage of a down round.

- Bridge Loan: Taking on debt to extend runway in hopes that metrics improve before the next priced round.

- Cost Cutting: Drastically reducing burn rate to avoid raising capital altogether.

However, if the market has shifted or the hype cycle has ended, a down round might be the only way to clear the market. It resets the expectations. It allows the company to clean up its cap table, reset the bar for success, and start building again from a solid foundation.

Founders must ask themselves if they are willing to accept a smaller piece of the pie to ensure the pie continues to exist.