Net profit represents the absolute bottom line of your financial statement. It is the number that tells you if your business actually creates value or if it merely consumes capital. While top line revenue gets the headlines and press coverage, net profit determines whether you can make payroll next month without raising more funds.

It is the actual profit remaining after you have paid every single obligation. This includes the cost of goods sold along with all working expenses, taxes, interest, and operating costs.

For a founder, this metric is the ultimate reality check. It strips away the optimism of sales figures and forces you to confront the efficiency of your entire operation.

The Difference Between Gross and Net

#It is common for new entrepreneurs to confuse gross profit with net profit. The distinction is critical for decision making.

Gross profit is what you make on the product or service itself. It is revenue minus the direct costs to produce that specific unit. It measures your production efficiency and pricing power.

Net profit goes much further. It takes that gross profit and subtracts everything else required to run the company. This includes:

- Rent and utilities

- Salaries for administrative staff

- Marketing and advertising spend

- Software subscriptions

- Legal and accounting fees

- Taxes and loan interest

You can have a healthy gross profit and still have a negative net profit. This scenario is actually the default state for many high growth startups.

The Startup Context

#In the startup world, net profit is often negative for a long time. This is usually referred to as your burn rate or net loss. You are spending more than you make to fuel growth.

This is acceptable if it is a strategic choice. You might be spending heavily on R&D or aggressive customer acquisition to capture market share.

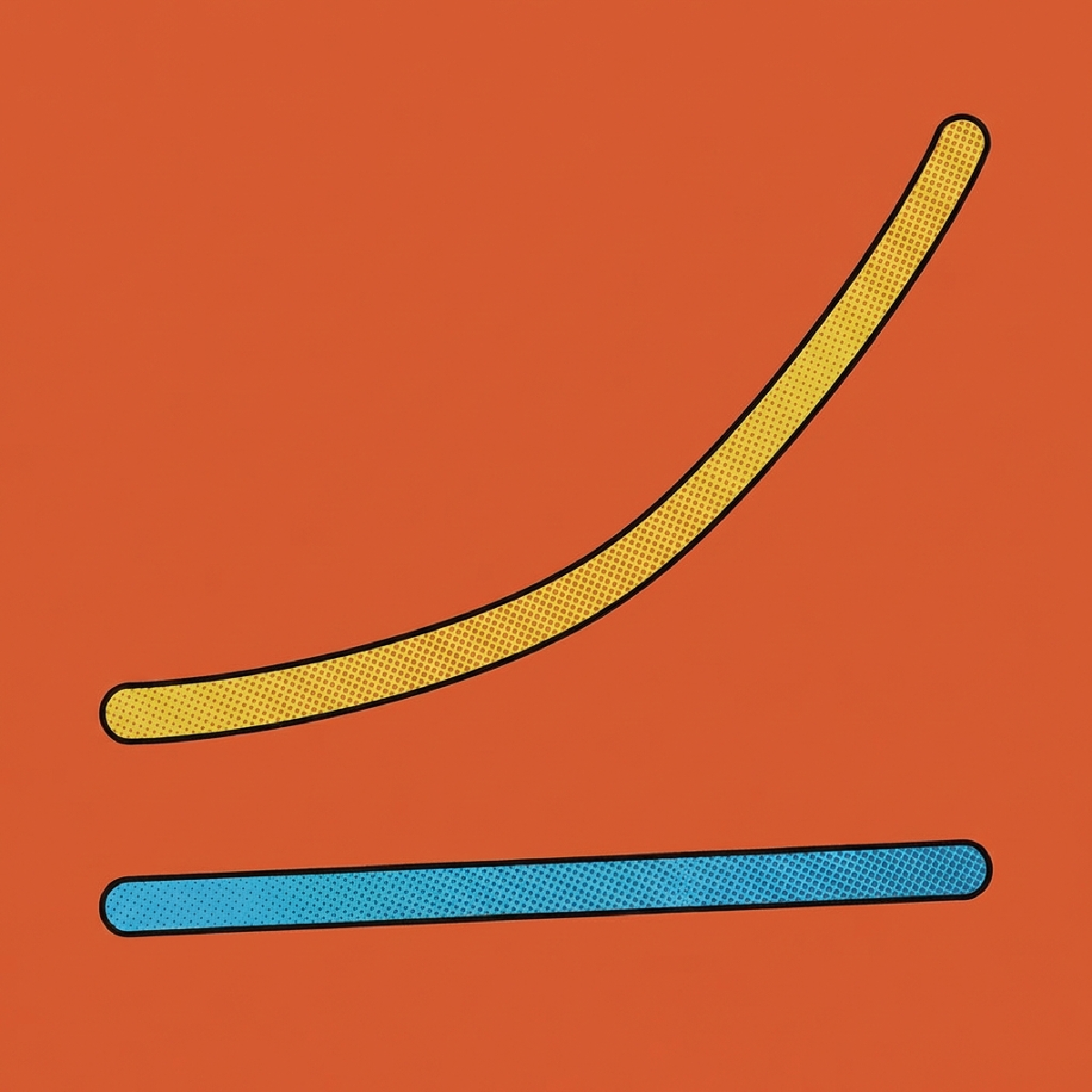

However, a negative net profit is a ticking clock. It means you are reliant on external capital or cash reserves to survive. You must constantly ask yourself when the crossover point will happen.

Building a model that eventually yields a healthy net profit is what separates a real business from a permanent fundraising project. Investors will tolerate losses for growth, but they eventually demand a path to profitability.

Analyzing Your Margins

#When you look at your net profit margin, which is net profit divided by revenue, you get a percentage that indicates your overall efficiency.

A low net margin suggests you are vulnerable to market shifts. If your costs increase slightly or sales dip, you could immediately swing into a loss.

A high net margin provides a buffer. It allows you to weather mistakes, invest in new experiments, or survive economic downturns without needing a lifeline.

Founders should look at this number to ask difficult questions. Are our operating expenses too high for our current revenue? Is our headcount sustainable? Are we spending money on marketing channels that do not convert?

Net profit is not just an accounting term. It is the score that tells you if you have built something that can stand on its own.