You open your laptop and check the tech news.

Another company has raised ten million dollars. You see the smiling faces of the founders. You read the quote about how they are going to change the world. You feel a familiar pang in your stomach.

It feels like jealousy. But it is actually anxiety.

You wonder if you are moving too slow. You wonder if you are missing the boat because you are funding your business from your savings account while your competitors are fueling up with venture capital.

There is a pervasive narrative in the startup ecosystem that fundraising is the goal. We celebrate the closing of a Series A as if the race has been won.

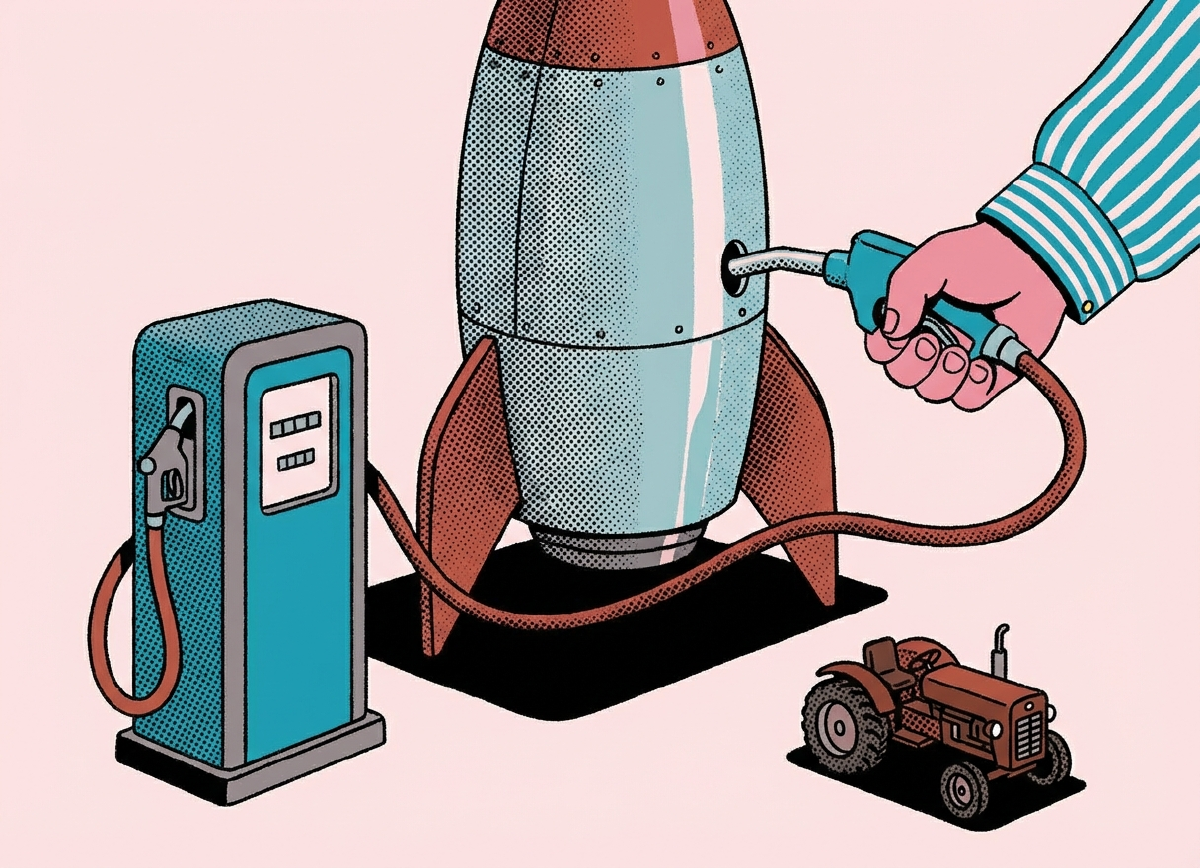

But fundraising is not winning. Fundraising is buying fuel. And if you put rocket fuel into a tractor, you do not get a fast tractor. You get an explosion.

We need to strip away the vanity metrics and look at the cold, hard mechanics of capital. We need to understand what happens when you sign that term sheet and what happens when you don’t.

The Psychology of the Check

#Why do founders raise money?

If you ask them, they will talk about hiring engineers or scaling marketing. But if you dig deeper, there is often a psychological driver.

Validation.

When a venture capitalist writes you a check, they are telling you that you are smart. They are telling you that your idea is worth something. For a founder operating in a vacuum of uncertainty, that validation is addictive.

But relying on investors for validation is a trap.

The Venture Capital Trap: Distinguishing Between Fuel and Validation

Venture Capital is a specific asset class designed for a specific type of growth. It requires you to grow at a rate that justifies a ten times return in a few years.

If your business is designed to grow steadily and profitably over twenty years, VC money will kill you. The investors will force you to make unnatural decisions to spike growth, eventually breaking the business or forcing you out.

The Innovation of Poverty

#So what is the alternative?

Constraints.

When you have zero dollars in the bank, you cannot solve problems by throwing money at them. You cannot hire a sales team to sell a mediocre product. You have to fix the product.

This is the hidden advantage of the bootstrapper.

The Gift of the Empty Bank Account: Why Constraints Create Better Companies

An empty bank account functions as a filter for bad ideas. It forces you to focus entirely on the customer because the customer is the only source of oxygen you have.

Companies that raise too much money too early often skip the crucial step of finding true product market fit. They use capital to mask their inefficiencies. When the money runs out, they realize they never actually built a sustainable business.

The Mechanics of the Raise

#However, some businesses truly require capital. If you are building hardware or a marketplace that needs liquidity, bootstrapping might be impossible.

If you choose to raise, you must understand the architecture of the deal. You are not just getting cash. You are entering into a complex legal structure.

Do you know the difference between a SAFE note and a Convertible Note? Do you understand how a priced round differs from a bridge round?

The Architecture of Early Stage Funding: Instruments and Stages

These instruments dictate the terms of your future. A SAFE note might seem simple and friendly, but it can create a massive dilution event later if you do not understand the valuation cap.

Ignorance here is not bliss. It is expensive. You need to treat the fundraising process with the same intellectual rigor you apply to your product roadmap.

The Most Expensive Currency

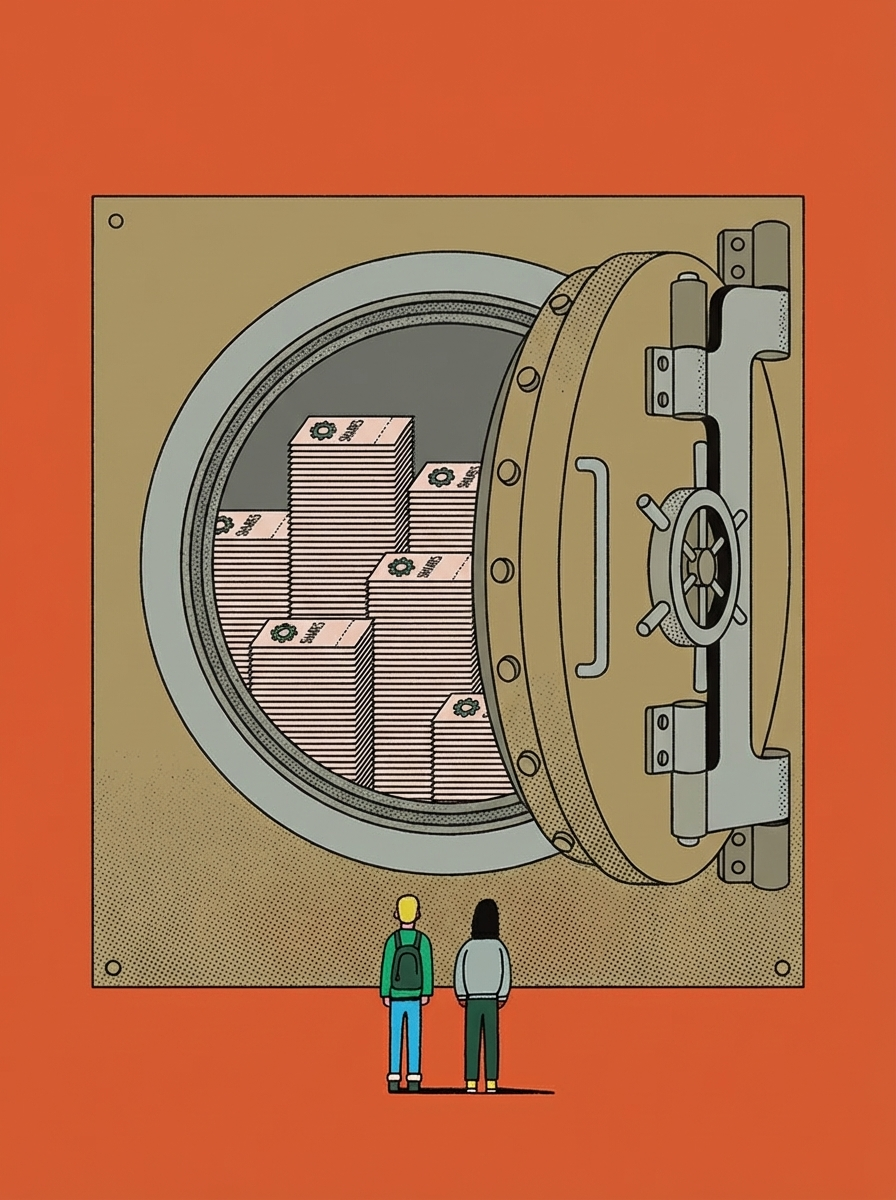

#When you take money, what are you giving up?

Equity.

Equity is the most expensive currency you will ever spend. You can always make more revenue. You can always get more loans. But you can never reprint the equity you gave away in the seed round.

But what is equity, really? It is not just a percentage of the upside. It is a bundle of rights.

It is the right to vote. The right to information. The right to control the board.

Founders often focus solely on the valuation number and ignore the governance terms. They celebrate raising at a high valuation only to realize they gave the investors veto power over their next hire. You must understand that you are selling ownership, and ownership implies control.

The Math of the Shrinking Pie

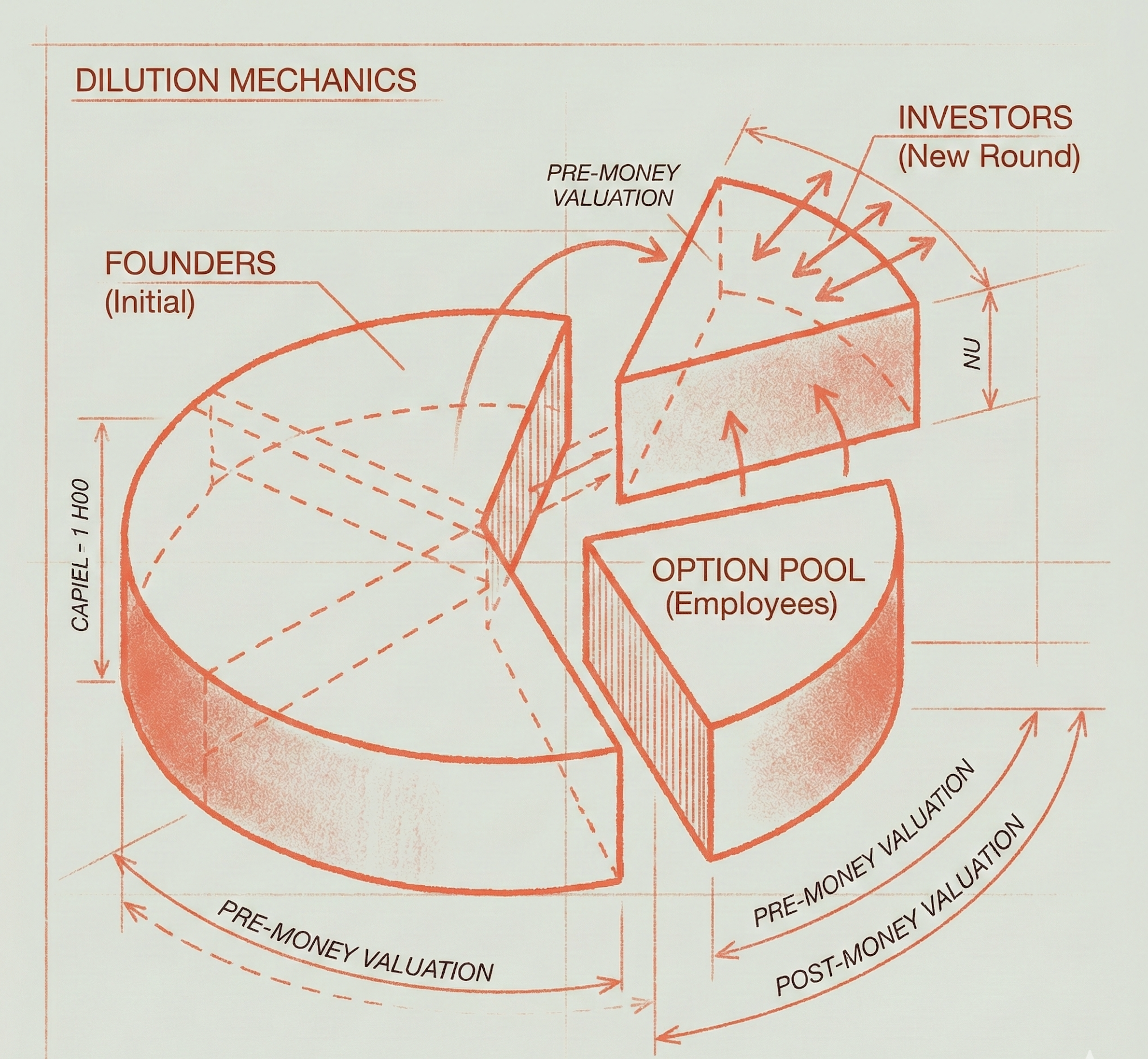

#Finally, we have to do the math.

Dilution is the concept that confuses most first time founders.

If you own 100 percent of a company worth one million dollars, and you sell 20 percent of it for two million dollars, you now own 80 percent of a company worth ten million dollars. Your slice of the pie got smaller, but the pie got bigger.

This is the theory.

A Walkthrough on Valuation and Dilution in Startups

In practice, it is messier. There are option pools for employees. There are pro rata rights for investors. There are down rounds where the valuation drops.

If you do not model this out in a spreadsheet before you sign, you are flying blind. You need to know exactly what your ownership stake will look like after the Series A, the Series B, and the eventual exit.

The Strategic Choice

#There is no moral superiority in bootstrapping. There is no glory in raising venture capital.

They are simply different energy sources for different types of machines.

The danger lies in misalignment.

If you want to build a lifestyle business that generates cash for your family for generations, do not take VC money. If you want to build a moonshot technology that requires ten years of R&D, do not try to bootstrap it on credit cards.

The most successful founders are the ones who view capital as a tool, not a trophy.

They look at the market. They look at their product. And they make a calculated decision about how to fuel the engine.

Before you build the pitch deck, ask yourself the hard question.

Are you raising money because you need to? Or are you raising money because you are afraid to build without it?