There is a word that often makes dedicated founders uncomfortable.

Exit.

It feels like a betrayal. You just started this company. You are in the trenches building the product and finding the first customers. Why would you spend valuable mental energy thinking about leaving? It feels like planning the divorce before the wedding.

But this discomfort stems from a fundamental misunderstanding of what an exit strategy actually is.

Most people think an exit strategy is a plan to quit. It is not.

An exit strategy is a plan to build an asset.

If you do not have an exit strategy, you likely do not have a business. You have a high stress job that you created for yourself. A business is an entity that exists independent of its creator. It has value that can be transferred. If the business relies entirely on your relationships, your specific genius, and your sixty hour work weeks, it has no transferrable value.

We need to reverse engineer the process. We need to look at what the end looks like so we can build the machine correctly today.

The Destination Defines the Vehicle

#Imagine you are building a vehicle. If you do not know if you are trying to cross an ocean or a desert, you cannot select the right engine.

Business works the same way. The daily decisions you make regarding your tech stack, your hiring process, and your legal structure all depend on where you want this thing to go.

Are you building this to sell to a private equity firm? They will care about EBITDA and standardized processes. Are you building this to be acquired by a strategic competitor like Google or Apple? They will care about intellectual property and engineering talent. Are you building this to pass down to your children? They will care about cash flow stability and brand reputation.

The Exit Strategy: Why the End Defines the Beginning

When you define the end, you clarify the beginning. If you know you want to sell to a competitor, you might make different decisions about your patent strategy today. If you want a cash flow lifestyle business, you will make different decisions about taking on venture capital.

Without this clarity, you risk building a vehicle that cannot get you where you eventually want to go. You might take money that forces a growth rate you cannot sustain. Or you might neglect the compliance documentation that a future buyer will require.

Operations as a Product

#Once you know the destination, you have to look at the engine.

This brings us to the most painful reality for founders. You are the bottleneck.

In the early days, this is necessary. You do everything because you have to. But as the company grows, your involvement becomes a liability. If every decision has to go through you, the company cannot scale. And more importantly, it cannot be sold.

A buyer does not want to buy you. They want to buy a machine that generates cash.

This means we have to look at your daily operations not just as tasks to be done, but as a product to be designed.

Designing the End: Why Your Exit Strategy Dictates Your Daily Operations

Every time you solve a problem, you should be asking a question. How do I solve this so I never have to solve it again? How do I document this process so someone with half my experience can get the same result?

This is the difference between working in the business and working on the business. When you design the operations to run without you, you are building equity. When you just do the work yourself, you are just saving on payroll.

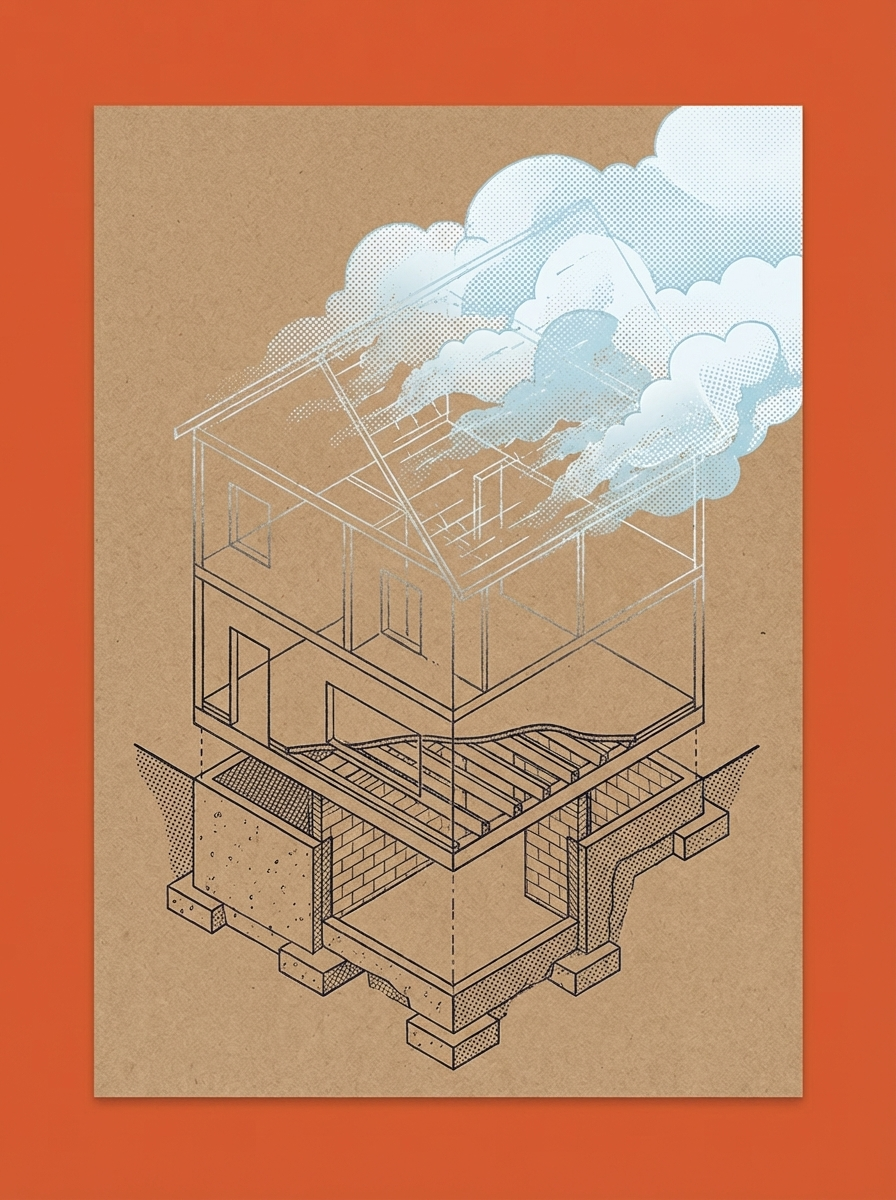

The Architecture of Permanence

#We have to take this a step further. It is not just about documenting tasks. It is about building a structure that can survive the chaos of the market.

We call this the Architecture of Permanence.

Many startups are held together by duct tape and the heroic efforts of the founding team. That works for a sprint. It does not work for a marathon. To build a sellable asset, you need to build systems that are robust.

This involves redundancy. If your lead engineer gets hit by a bus, does the code base die? If your top salesperson quits, does revenue drop by fifty percent?

The Architecture of Permanence: Building a Business That Outlives You

Building for permanence means creating a culture and a structure where the institution is stronger than the individual. It means having data redundancy. It means having clear succession plans for key roles.

Ironically, by making yourself unnecessary, you become more valuable. You move from being the engine to being the architect. You can step away for a month and the business grows. That is the definition of a sellable asset.

The Autopsy of the Living

#Let us assume you have built the machine. It runs well. You are ready to explore an exit.

This is where the dream often dies.

It dies in a room called Due Diligence. This is where lawyers and accountants from the buyer’s side tear your business apart to look for risks. They will look at every contract. They will look at every line of code. They will look at every tax filing.

If they find skeletons, the deal dies. Or the price gets cut in half.

Most founders wait until the deal is on the table to think about this. That is too late. You need to perform an autopsy on your business while it is still alive.

The Autopsy of the Living: How to Survive Due Diligence Before It Happens

You need to look for the rot. Do you actually own the IP for that logo your cousin designed five years ago? are your employment contracts compliant with the new labor laws in your state? Is your customer concentration too high?

By conducting this audit now, you can fix the issues while the stakes are low. You can clean up the cap table. You can formalize the handshake deals. You treat the business with the rigor of a public company long before you go public.

The Ultimate Paradox

#Here is the beautiful contradiction of this entire philosophy.

The things you do to make a company sellable are the exact same things you should do if you want to keep it forever.

If you build a company that runs without you, you have freedom. You can choose to sell it for a life changing sum. Or you can choose to keep it and enjoy the cash flow while working twenty hours a week.

If you build a company that relies on you, you have no choice. You cannot sell it because it is worthless without you. And you cannot keep it without burning out.

So we reverse engineer the exit not because we are desperate to leave. We do it because we are desperate for options.

We do it because we want to build something that matters. Something that lasts. Something that is solid.

When you look at your business today, ask yourself the hard question. Are you building a machine? or are you just building a cage?