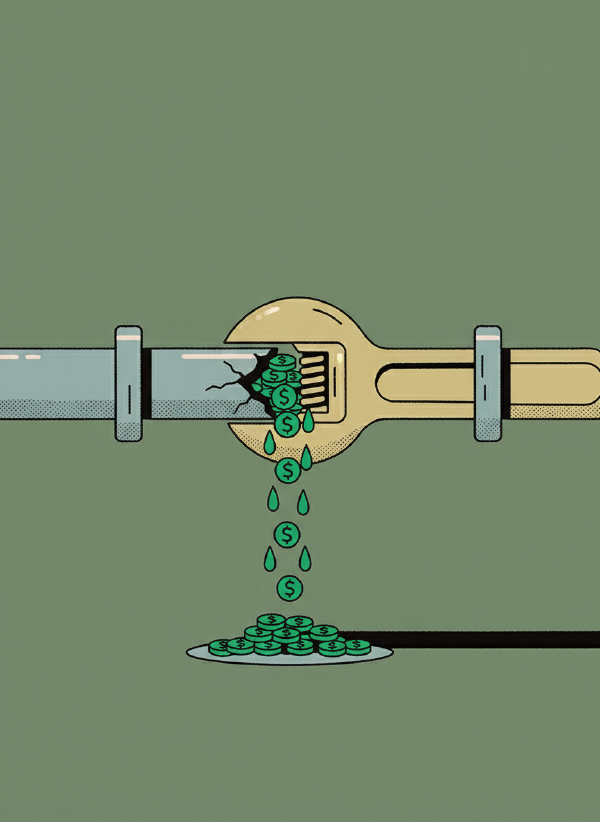

Mastering Burn Rate: Financial Survival Tactics for Growth and Longevity

·5 mins

This guide explores essential financial strategies for startups, focusing on burn rate, cash flow management, and the discipline of regular financial audits to maintain operational health.